capital gains tax budget news

OTTAWA Over one quarter of Canadians who made over 400000 in 2019 paid less than the 15 per cent in federal tax in 2019 a surprising number that has the Liberal. The Portuguese government has proposed a new cryptocurrency tax policy that would take effect as part of its 2023 national budget according to a government-issued report.

Three Different Routes To Save Tax On Long Term Capital Gains Mint

Now something thats pretty.

. The new budget draft however calls for a levy of 28 on capital gains from cryptocurrency assets held for less than a year. Venture capital investors and startup founders are likely to benefit from a tax tweak announced in Budget 2022-23. The government has proposed significant changes in the tax framework of the capital gain on immovable properties under the federal budget for the fiscal year 2022-23.

Heres how to pay 0 capital gains taxes with a six-figure income. Fernando Medina Portugals finance minister has recently submitted a budget draft proposal to parliament calling for a 28 tax on capital gains from cryptocurrencies such. Today the House Budget Committee released a report on the need to enact fiscal policies that provide targeted relief to working Americans and small.

Govt starts work to bring parity to long-term capital gains tax laws Currently returns from listed stocks or shares are taxed at 10 if they are held at least for a year. But if you sell a. Capital gains taxes have something of a reputation.

Short-term capital gains or gains from the sale of assets that you owned for a year or less are subject to ordinary income tax. Explore Perspectives on Markets Outlooks and Sector Deep Dives with Industry Pros. 21 hours agoIn case the capital gains are long-term in nature one can claim exemption under Section 54 of the Income-tax Act 1961 if heshe invests the capital gains for purchase or.

January 27 2022 1244 PM IST. An earlier version of the story used a rounded number for the 2022 standard deduction that was slightly. On May 28 th Bidens budget revealed plans to raise the marginal income tax rate up from 37 to 396.

Entrepreneurs relief was slashed last. While traders and investors have seen Portugal as a crypto-friendly region for payments and tax the countrys government has proposed a massive 28 tax on all capital. The countrys Finance Minister Fernando Medina submitted a new budget draft proposal that calls for a 28 levy on capital gains from cryptocurrency assets held for less.

If you buy a listed bond then you pay long-term capital gains LTCG tax of 10 percent if you hold it for more than 12 months. Capital Gains Tax News Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains. On top of this the administration is aiming to increase the long-term.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Jay Inslee on Thursday unveiled a 2021-23 operating budget proposal that includes 576 billion in spending for state operations such as schools prisons. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one floated change to capital gains.

A provision in the countrys proposed 2023 budget would tax gains on crypto holdings held for less than one year at a rate of 28 according to the plan submitted to. The surcharge on long-term capital. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

Following a simplification review Capital Gains Tax CGT is an area that we have been expecting to hear some major announcements in but the Chancellor decided to leave. Most investors will be liable to pay income tax on the coupon outsider of tax shelters. Gains on cryptos held for a period of longer.

Ad Market and Investing Insights from Capital Group Investment Professionals to You. 1 day agoFor all investors the capital gain portion is tax-free with gilts. The draft features a provision allowing authorities to tax gains on crypto holdings held for less than a year at a rate of 28 Bloomberg reported quoting the document.

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

Capital Gains Tax Budget And Policy Center

Capital Gains May Have Triggered More Individual Taxes For 2021

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Capital Gains Tax Budget And Policy Center

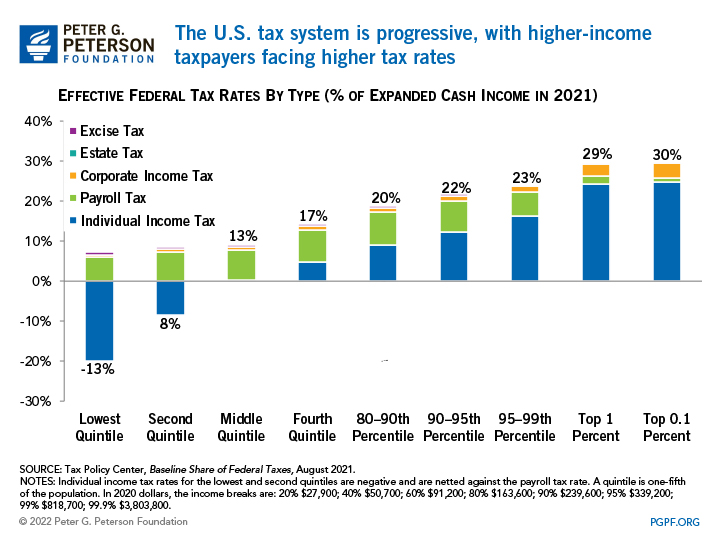

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Inslee Proposes State Capital Gains Tax Peninsula Daily News

Capital Gains Taxes Are Going Up

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Budget 2017 Market To Correct 5 10 If Fm Slaps Long Term Capital Gains Tax In Budget The Economic Times

House Democrats Use Capital Gains Tax To Keep Property Tax Rate Lower Heraldnet Com

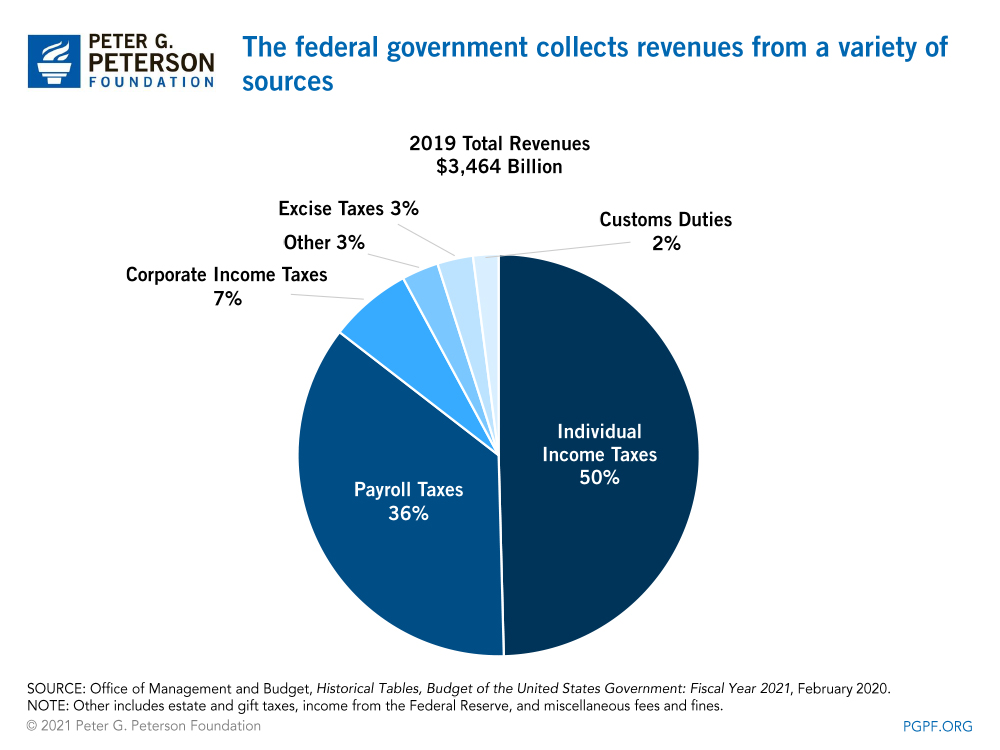

Understanding The Budget Revenues

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

President Biden S Capital Gains Tax Plan Forbes Advisor

Capital Gains Hike Faces Budget Issue Without Other Changes

Budget Taxes Archives Page 4 Of 6 Peter Abbarno

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget